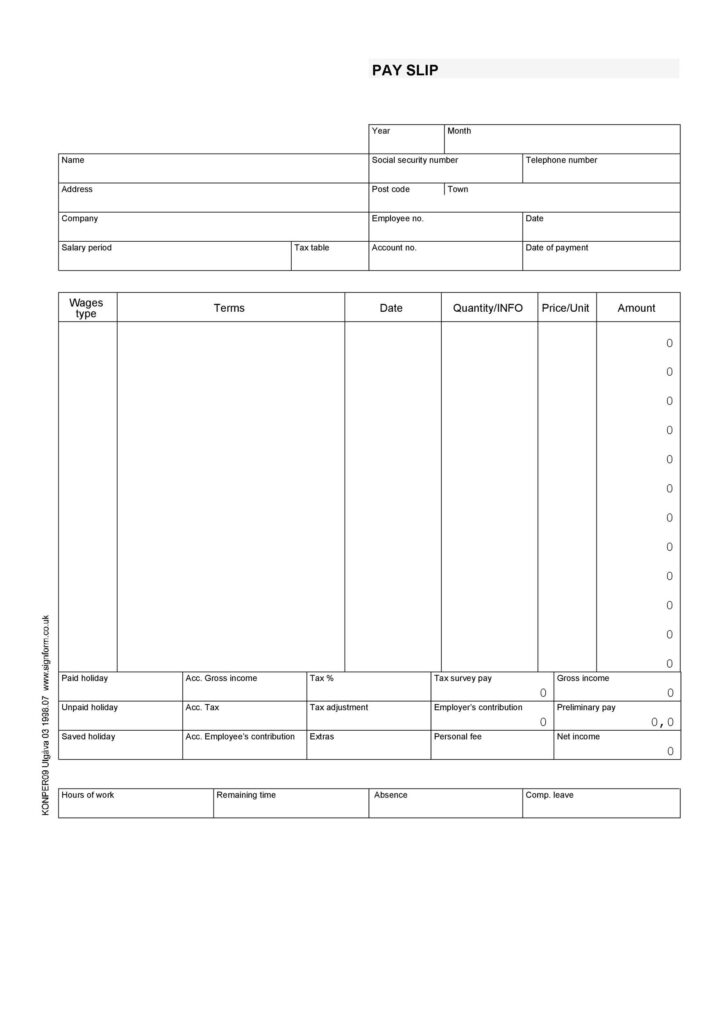

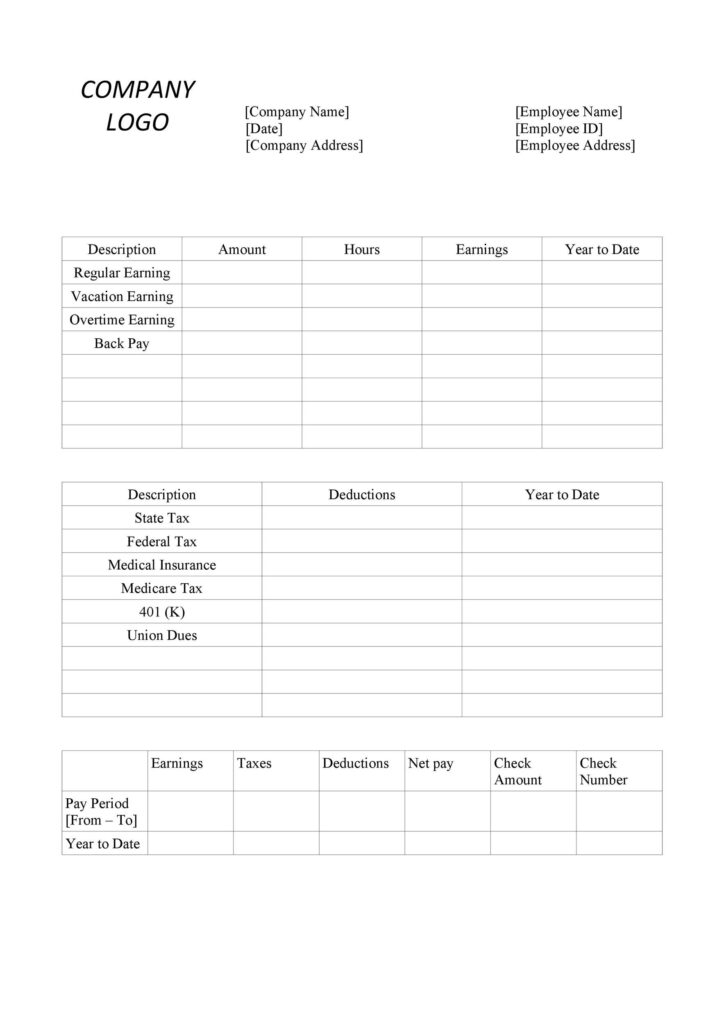

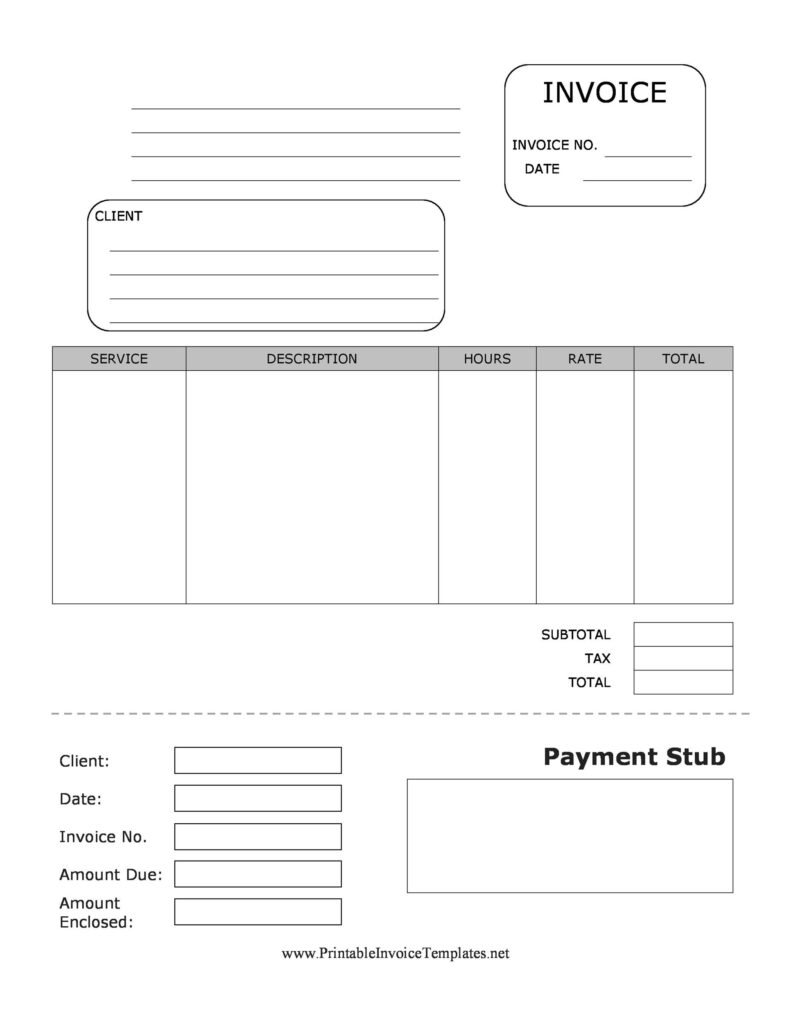

A great collection of pay stub templates is waiting for you at the bottom of page. You can pick up any of them to create pay stubs for your workers or employees. A printer or written piece of paper that an employee received from employer or company when paid for the salary of month is recognized as pay stub. A detailed pay stub provides details about employee’s salary such as how much money he or she has earned during the month, deductions made by the employer for settlement of account, employee’s contribution to insurance and other funds and how much tax has been taken away by the employer etc. We do hope that you will like these free pay stub templates.

Features of pay stub templates:

Pay stub is also known as paycheck stub in various business organizations and companies. A well prepared pay stub gives an employee complete account of information about salary paid by the company or employer. Usually pay stubs are attached to a pay check and often sent to employee via mail when payment deposited in the employee bank account as direct deposit. Basically a pay stub tells you how many hours you worked in particular period of time usually a month and how much you make in each hour.

Large number of companies and business organizations are using expensive software and computer programs for creating professional looking pay stubs. On another hand, small businesses and companies cannot afford such expensive programs and software to do so however here we have organized a collection of pay stub templates and paycheck stub templates for all our users. Use of the pay stub template can help a company a lot in making pay stubs for employees and workers. After downloading an appropriate pay stub template, a user can simply add own details into the template to generate suitable pay stubs in just few minutes.

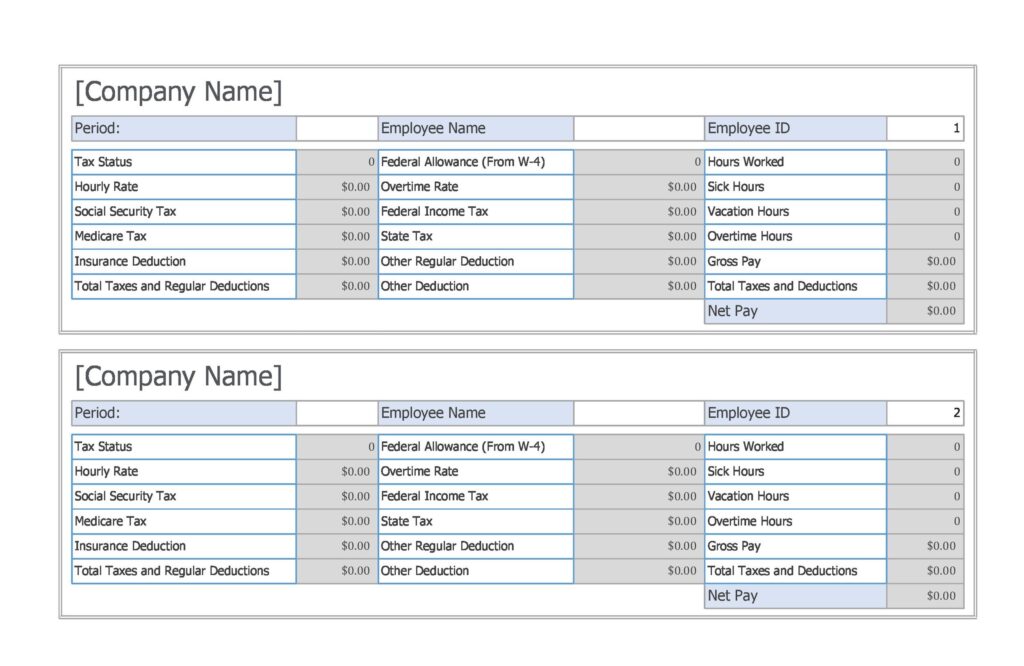

Free Pay Check Stub Template

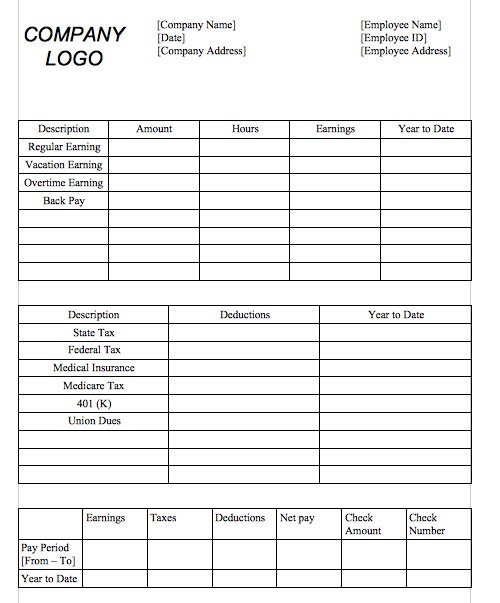

Paycheck Stub Template in Word

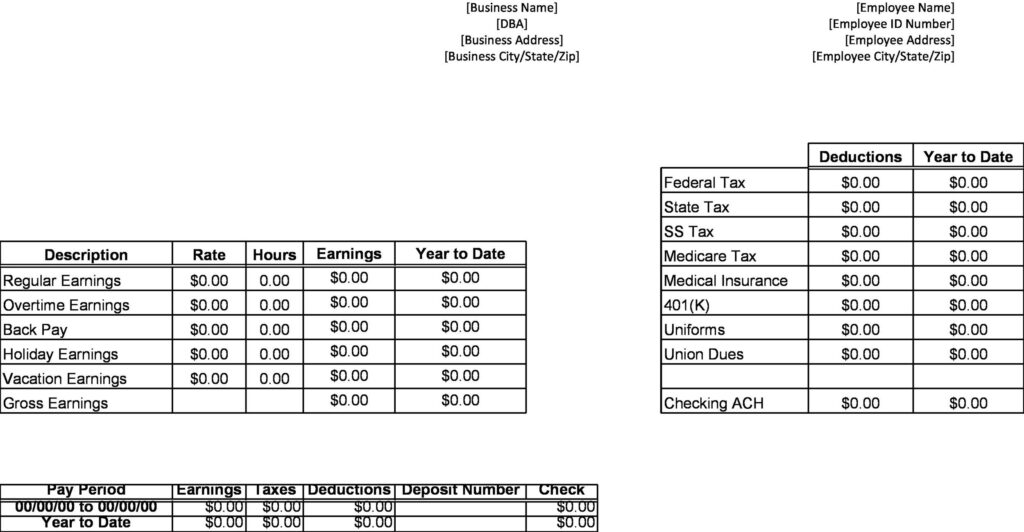

Sample Payroll Calculator Example

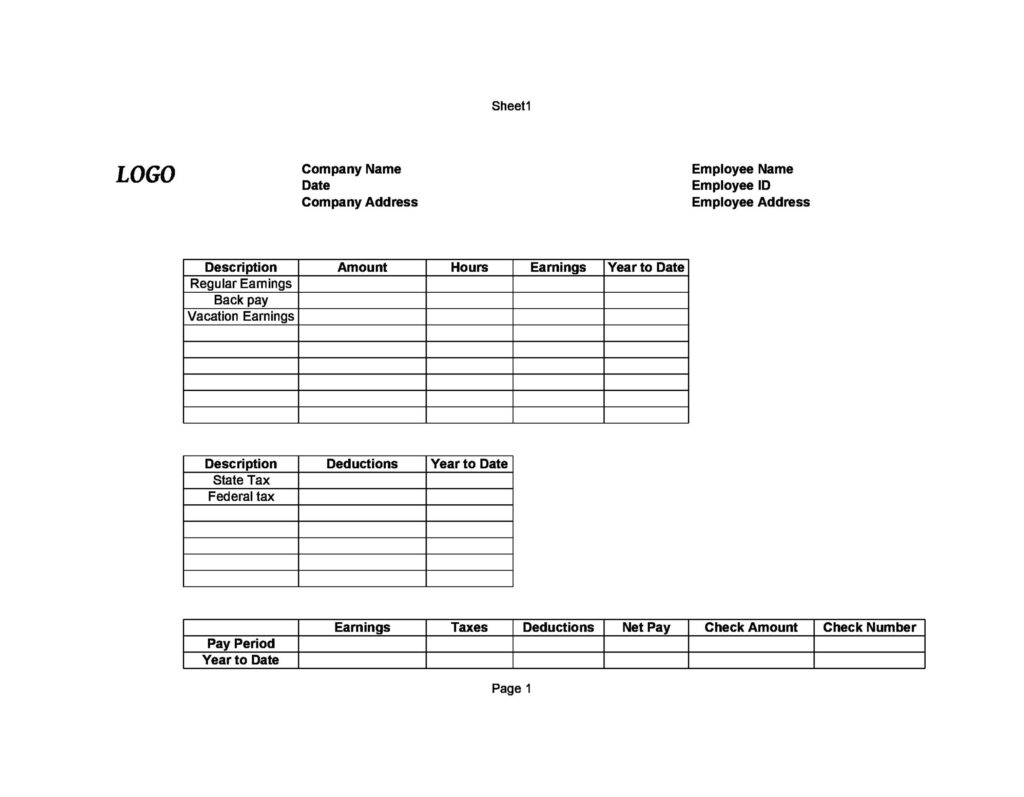

Earning statement (Pay Stub) sample

Word Pay Stub Template

Pay Stub Template In Excel

Pay Stub Template in Excel Format Free

You must be logged in to post a comment.